Is it The End of Ethereum and Solana?

"Bitcoin's DeFi Layer 1 Metaprotocol Will Shake the Foundations of the Entire Crypto Industry"

"Bitcoin's DeFi Layer 1 Metaprotocol Will Shake the Foundations of the Entire Crypto Industry"

"Bitcoin's DeFi Layer 1 Metaprotocol Will Shake the Foundations of the Entire Crypto Industry"

September 2024

Blockchain Newsletter

Cyrille de Lange, Natalija Gavrilovic, Sascha Oroz, Muhammad Wasil

Cyrille de Lange, Natalija Gavrilovic, Sascha Oroz, Muhammad Wasil

Cyrille de Lange, Natalija Gavrilovic,

Sascha Oroz, Muhammad Wasil

"In the race for innovation, trust is the final frontier – Bitcoin just crossed it."

- Cyrille de Lange

What if your perspective on Bitcoin suddenly turned upside down?

Picture Bitcoin, once seen as merely the original cryptocurrency, evolving beyond its current capabilities and surpassing blockchains like Ethereum and Solana.

Bitcoin is at a tipping point, fundamentally changing how the cryptocurrency world perceives and understands its role.

With the addition of smart contracts and decentralised applications, it is strengthening its dominance while maintaining unmatched trust, security, and decentralisation.

No longer limited to just being a store of value, Bitcoin is on the brink of becoming the leading platform for trust, innovation, and decentralised finance.

This revolutionary protocol unlocks full smart contract functionality, putting other platforms at risk of becoming irrelevant.

The question looms: when Bitcoin can do it all, why look elsewhere? The answer to this could reshape the future of decentralised finance forever.

What if your perspective on Bitcoin suddenly turned upside down?

Picture Bitcoin, once seen as merely the original cryptocurrency, evolving beyond its current capabilities and surpassing blockchains like Ethereum and Solana.

Bitcoin is at a tipping point, fundamentally changing how the cryptocurrency world perceives and understands its role.

With the addition of smart contracts and decentralised applications, it is strengthening its dominance while maintaining unmatched trust, security, and decentralisation.

No longer limited to just being a store of value, Bitcoin is on the brink of becoming the leading platform for trust, innovation, and decentralised finance.

This revolutionary protocol unlocks full smart contract functionality, putting other platforms at risk of becoming irrelevant.

The question looms: when Bitcoin can do it all, why look elsewhere? The answer to this could reshape the future of decentralised finance forever.

What if your perspective on Bitcoin suddenly turned upside down?

Picture Bitcoin, once seen as merely the original cryptocurrency, evolving beyond its current capabilities and surpassing blockchains like Ethereum and Solana.

Bitcoin is at a tipping point, fundamentally changing how the cryptocurrency world perceives and understands its role.

With the addition of smart contracts and decentralised applications, it is strengthening its dominance while maintaining unmatched trust, security, and decentralisation.

No longer limited to just being a store of value, Bitcoin is on the brink of becoming the leading platform for trust, innovation, and decentralised finance.

This revolutionary protocol unlocks full smart contract functionality, putting other platforms at risk of becoming irrelevant.

The question looms: when Bitcoin can do it all, why look elsewhere? The answer to this could reshape the future of decentralised finance forever.

DeFi on Bitcoin – A Market Yet to Exist

Bitcoin has long stood as the most trusted and secure cryptocurrency network. Despite its dominance, it has lagged in one critical area: Decentralised Finance.

Decentralised Finance has been a transformative force on Ethereum, driving a new wave of financial innovation through decentralised exchanges, lending protocols, and synthetic assets.

Ethereum leads the DeFi space, boasting a market cap of $315 billion, with a total value locked (TVL) of nearly 50$ billion as of August 2024, with the TVL representing approximately 15% of its market cap (CoinMarketCap, 2024). This has cemented Ethereum as the backbone of the DeFi ecosystem, enabling users to engage in decentralised financial services.

Meanwhile, Bitcoin lacks a comparable DeFi framework. Bitcoin's complex and under-documented scripting language, Bitcoin Script, has hindered the development of a true DeFi ecosystem, leaving a significant untapped opportunity in the market.

"Bitcoin’s scripting language has limitations that make it unsuitable for certain applications, but these challenges create opportunities for innovation."

— Andreas Antonopoulos, Mastering Bitcoin, July 2020.

In recent years, several projects such as Runes, Ordinals, and BRC-20 have attempted to extend Bitcoin’s capabilities. Despite their innovations, they have encountered challenges in functionality, scalability, and user experience, particularly when it comes to enabling decentralised finance and other advanced applications.

This is where our partner steps in, introducing a revolutionary new Layer 1 metaprotocol that brings DeFi smart contract functionalities to Bitcoin, addressing this gap in the market.

Several factors give Bitcoin a competitive edge in DeFi. Its unmatched security, global recognition, and the deeply rooted institutional and governmental acceptance offer a foundation of trust that no other blockchain can replicate.

BlackRock recently stated Bitcoin could be a "hedge against increasing global disorder and declining trust in governments, banks, and fiat currencies" (2024), showcasing the growing institutional confidence in its value.

With these factors in place, Bitcoin is poised not only to catch up, but potentially surpass both Ethereum and Solana in the DeFi market.

For investors, this shift signals opportunities in Bitcoin-based DeFi protocols, especially as traditional DeFi projects on Ethereum become more saturated. Bitcoin’s established credibility and new smart contract capabilities could attract more institutional interest and capital, offering unique entry points for venture capitalists and private equity firms

DeFi on Bitcoin – A Market Yet to Exist

Bitcoin has long stood as the most trusted and secure cryptocurrency network. Despite its dominance, it has lagged in one critical area: Decentralised Finance.

Decentralised Finance has been a transformative force on Ethereum, driving a new wave of financial innovation through decentralised exchanges, lending protocols, and synthetic assets.

Ethereum leads the DeFi space, boasting a market cap of $315 billion, with a total value locked (TVL) of nearly 50$ billion as of August 2024, with the TVL representing approximately 15% of its market cap (CoinMarketCap, 2024). This has cemented Ethereum as the backbone of the DeFi ecosystem, enabling users to engage in decentralised financial services.

Meanwhile, Bitcoin lacks a comparable DeFi framework. Bitcoin's complex and under-documented scripting language, Bitcoin Script, has hindered the development of a true DeFi ecosystem, leaving a significant untapped opportunity in the market.

"Bitcoin’s scripting language has limitations that make it unsuitable for certain applications, but these challenges create opportunities for innovation."

— Andreas Antonopoulos, Mastering Bitcoin, July 2020.

In recent years, several projects such as Runes, Ordinals, and BRC-20 have attempted to extend Bitcoin’s capabilities. Despite their innovations, they have encountered challenges in functionality, scalability, and user experience, particularly when it comes to enabling decentralised finance and other advanced applications.

This is where our partner steps in, introducing a revolutionary new Layer 1 metaprotocol that brings DeFi smart contract functionalities to Bitcoin, addressing this gap in the market.

Several factors give Bitcoin a competitive edge in DeFi. Its unmatched security, global recognition, and the deeply rooted institutional and governmental acceptance offer a foundation of trust that no other blockchain can replicate.

BlackRock recently stated Bitcoin could be a "hedge against increasing global disorder and declining trust in governments, banks, and fiat currencies" (2024), showcasing the growing institutional confidence in its value.

With these factors in place, Bitcoin is poised not only to catch up, but potentially surpass both Ethereum and Solana in the DeFi market.

For investors, this shift signals opportunities in Bitcoin-based DeFi protocols, especially as traditional DeFi projects on Ethereum become more saturated. Bitcoin’s established credibility and new smart contract capabilities could attract more institutional interest and capital, offering unique entry points for venture capitalists and private equity firms

DeFi on Bitcoin – A Market Yet to Exist

Bitcoin has long stood as the most trusted and secure cryptocurrency network. Despite its dominance, it has lagged in one critical area: Decentralised Finance.

Decentralised Finance has been a transformative force on Ethereum, driving a new wave of financial innovation through decentralised exchanges, lending protocols, and synthetic assets.

Ethereum leads the DeFi space, boasting a market cap of $315 billion, with a total value locked (TVL) of nearly 50$ billion as of August 2024, with the TVL representing approximately 15% of its market cap (CoinMarketCap, 2024). This has cemented Ethereum as the backbone of the DeFi ecosystem, enabling users to engage in decentralised financial services.

Meanwhile, Bitcoin lacks a comparable DeFi framework. Bitcoin's complex and under-documented scripting language, Bitcoin Script, has hindered the development of a true DeFi ecosystem, leaving a significant untapped opportunity in the market.

"Bitcoin’s scripting language has limitations that make it unsuitable for certain applications, but these challenges create opportunities for innovation."

— Andreas Antonopoulos, Mastering Bitcoin, July 2020.

In recent years, several projects such as Runes, Ordinals, and BRC-20 have attempted to extend Bitcoin’s capabilities. Despite their innovations, they have encountered challenges in functionality, scalability, and user experience, particularly when it comes to enabling decentralised finance and other advanced applications.

This is where our partner steps in, introducing a revolutionary new Layer 1 metaprotocol that brings DeFi smart contract functionalities to Bitcoin, addressing this gap in the market.

Several factors give Bitcoin a competitive edge in DeFi. Its unmatched security, global recognition, and the deeply rooted institutional and governmental acceptance offer a foundation of trust that no other blockchain can replicate.

BlackRock recently stated Bitcoin could be a "hedge against increasing global disorder and declining trust in governments, banks, and fiat currencies" (2024), showcasing the growing institutional confidence in its value.

With these factors in place, Bitcoin is poised not only to catch up, but potentially surpass both Ethereum and Solana in the DeFi market.

For investors, this shift signals opportunities in Bitcoin-based DeFi protocols, especially as traditional DeFi projects on Ethereum become more saturated. Bitcoin’s established credibility and new smart contract capabilities could attract more institutional interest and capital, offering unique entry points for venture capitalists and private equity firms

The Potential Value Locked in Bitcoin’s DeFi Future

If we apply Ethereum’s DeFi market penetration metrics to Bitcoin, the potential for growth is substantial. Bitcoin’s current market cap is $1.15 trillion as of August 2024. By applying the 15% TVL ratio seen in Ethereum's ecosystem, Bitcoin could see $183 billion locked in DeFi applications, far exceeding Ethereum’s DeFi market.

The Potential Value Locked in Bitcoin’s DeFi Future

If we apply Ethereum’s DeFi market penetration metrics to Bitcoin, the potential for growth is substantial. Bitcoin’s current market cap is $1.15 trillion as of August 2024. By applying the 15% TVL ratio seen in Ethereum's ecosystem, Bitcoin could see $183 billion locked in DeFi applications, far exceeding Ethereum’s DeFi market.

The Potential Value Locked in Bitcoin’s DeFi Future

If we apply Ethereum’s DeFi market penetration metrics to Bitcoin, the potential for growth is substantial. Bitcoin’s current market cap is $1.15 trillion as of August 2024. By applying the 15% TVL ratio seen in Ethereum's ecosystem, Bitcoin could see $183 billion locked in DeFi applications, far exceeding Ethereum’s DeFi market.

This would not only surpass Ethereum’s DeFi market three times over but also solidify its status in DeFi as the most trusted and decentralised network in the cryptocurrency landscape.

The smart contract capabilities while preserving Bitcoin's core attributes, set the stage for a thriving DeFi ecosystem. Research by Fidelity and Bloomberg Intelligence, suggests Bitcoin’s market cap could reach $2 trillion in this bull market cycle. With this growth, the TVL in Bitcoin based DeFi applications have potential of exceeding $300 billion, assuming the same 15% market cap-to-TVL ratio seen with Ethereum.

This would not only surpass Ethereum’s DeFi market three times over but also solidify its status in DeFi as the most trusted and decentralised network in the cryptocurrency landscape.

The smart contract capabilities while preserving Bitcoin's core attributes, set the stage for a thriving DeFi ecosystem. Research by Fidelity and Bloomberg Intelligence, suggests Bitcoin’s market cap could reach $2 trillion in this bull market cycle. With this growth, the TVL in Bitcoin based DeFi applications have potential of exceeding $300 billion, assuming the same 15% market cap-to-TVL ratio seen with Ethereum.

This would not only surpass Ethereum’s DeFi market three times over but also solidify its status in DeFi as the most trusted and decentralised network in the cryptocurrency landscape.

The smart contract capabilities while preserving Bitcoin's core attributes, set the stage for a thriving DeFi ecosystem. Research by Fidelity and Bloomberg Intelligence, suggests Bitcoin’s market cap could reach $2 trillion in this bull market cycle. With this growth, the TVL in Bitcoin based DeFi applications have potential of exceeding $300 billion, assuming the same 15% market cap-to-TVL ratio seen with Ethereum.

The Bitcoin-Aligned Smart Contract Metaprotocol Set to Revolutionise Bitcoin's Ecosystem

"The idea of introducing smart contracts to Bitcoin without compromising its security is a game changer. If we can do that, Bitcoin will become the ultimate platform for decentralized finance."

— Nick Szabo, Keynote Speech at Bitcoin Conference, June 2019

The Bitcoin-aligned metaprotocol aims to overcome current limitations and bring full smart contract functionality to the Bitcoin blockchain. This innovative approach utilises Bitcoin's Tapscript capability while avoiding the need for Bitcoin Improvement Proposals (BIPs). It marks the start of a period where Bitcoin's core advantages are enhanced with sophisticated programmable features.

What sets this metaprotocol apart is its design as a public community good. Unlike traditional models, it doesn’t rely on exclusive tokens or centralised points of control. Instead, it offers developers and users the freedom to create and engage with decentralised applications (dApps) within the Bitcoin ecosystem.

This open and collaborative framework ensures that innovation and value are distributed across the entire ecosystem, reinforcing Bitcoin's core principles of decentralisation and trustless operation.

The Bitcoin-Aligned Smart Contract Metaprotocol Set to Revolutionise Bitcoin's Ecosystem

"The idea of introducing smart contracts to Bitcoin without compromising its security is a game changer. If we can do that, Bitcoin will become the ultimate platform for decentralized finance."

— Nick Szabo, Keynote Speech at Bitcoin Conference, June 2019

The Bitcoin-aligned metaprotocol aims to overcome current limitations and bring full smart contract functionality to the Bitcoin blockchain. This innovative approach utilises Bitcoin's Tapscript capability while avoiding the need for Bitcoin Improvement Proposals (BIPs). It marks the start of a period where Bitcoin's core advantages are enhanced with sophisticated programmable features.

What sets this metaprotocol apart is its design as a public community good. Unlike traditional models, it doesn’t rely on exclusive tokens or centralised points of control. Instead, it offers developers and users the freedom to create and engage with decentralised applications (dApps) within the Bitcoin ecosystem.

This open and collaborative framework ensures that innovation and value are distributed across the entire ecosystem, reinforcing Bitcoin's core principles of decentralisation and trustless operation.

The Bitcoin-Aligned Smart Contract Metaprotocol Set to Revolutionise Bitcoin's Ecosystem

"The idea of introducing smart contracts to Bitcoin without compromising its security is a game changer. If we can do that, Bitcoin will become the ultimate platform for decentralized finance."

— Nick Szabo, Keynote Speech at Bitcoin Conference, June 2019

The Bitcoin-aligned metaprotocol aims to overcome current limitations and bring full smart contract functionality to the Bitcoin blockchain. This innovative approach utilises Bitcoin's Tapscript capability while avoiding the need for Bitcoin Improvement Proposals (BIPs). It marks the start of a period where Bitcoin's core advantages are enhanced with sophisticated programmable features.

What sets this metaprotocol apart is its design as a public community good. Unlike traditional models, it doesn’t rely on exclusive tokens or centralised points of control. Instead, it offers developers and users the freedom to create and engage with decentralised applications (dApps) within the Bitcoin ecosystem.

This open and collaborative framework ensures that innovation and value are distributed across the entire ecosystem, reinforcing Bitcoin's core principles of decentralisation and trustless operation.

The Technology Behind OP_NET

Limitations of Current Bitcoin Protocols

To understand the significance of this metaprotocol, it's essential to understand the shortcomings of Bitcoin’s existing metaprotocols like Ordinals, BRC-20, and Runes. While these protocols have paved the way for tokenization on Bitcoin, they come with significant limitations. They rely heavily on Partially Signed Bitcoin Transactions (PSBTs) to operate in a non-custodial manner, limiting transaction capabilities.

The Technology Behind OP_NET

Limitations of Current Bitcoin Protocols

To understand the significance of this metaprotocol, it's essential to understand the shortcomings of Bitcoin’s existing metaprotocols like Ordinals, BRC-20, and Runes. While these protocols have paved the way for tokenization on Bitcoin, they come with significant limitations. They rely heavily on Partially Signed Bitcoin Transactions (PSBTs) to operate in a non-custodial manner, limiting transaction capabilities.

The Technology Behind OP_NET

Limitations of Current Bitcoin Protocols

To understand the significance of this metaprotocol, it's essential to understand the shortcomings of Bitcoin’s existing metaprotocols like Ordinals, BRC-20, and Runes. While these protocols have paved the way for tokenization on Bitcoin, they come with significant limitations. They rely heavily on Partially Signed Bitcoin Transactions (PSBTs) to operate in a non-custodial manner, limiting transaction capabilities.

For instance, BRC-20 tokens often function similarly to NFTs, requiring complex and manual processes for exchanges. This creates an environment better suited for NFT trading rather than a true DeFi ecosystem. The limitations in indexers, currently restricted to basic commands like Deploy, Mint, and Transfer, further hinder development, making it difficult for decentralised exchanges (DEXs) to thrive.

Despite various attempts, no DEX for BRC-20 or Runes has gained significant traction. The reason is clear: existing protocols lack the advanced functionalities required for DeFi, such as seamless asset transactions and smart contract interactions.

Most platforms that claim to offer decentralised trading still rely on custodial models, where users’ assets are effectively controlled by a centralised entity. This makes it challenging for truly decentralised systems to emerge, highlighting the need for a more robust infrastructure.

For instance, BRC-20 tokens often function similarly to NFTs, requiring complex and manual processes for exchanges. This creates an environment better suited for NFT trading rather than a true DeFi ecosystem. The limitations in indexers, currently restricted to basic commands like Deploy, Mint, and Transfer, further hinder development, making it difficult for decentralised exchanges (DEXs) to thrive.

Despite various attempts, no DEX for BRC-20 or Runes has gained significant traction. The reason is clear: existing protocols lack the advanced functionalities required for DeFi, such as seamless asset transactions and smart contract interactions.

Most platforms that claim to offer decentralised trading still rely on custodial models, where users’ assets are effectively controlled by a centralised entity. This makes it challenging for truly decentralised systems to emerge, highlighting the need for a more robust infrastructure.

For instance, BRC-20 tokens often function similarly to NFTs, requiring complex and manual processes for exchanges. This creates an environment better suited for NFT trading rather than a true DeFi ecosystem. The limitations in indexers, currently restricted to basic commands like Deploy, Mint, and Transfer, further hinder development, making it difficult for decentralised exchanges (DEXs) to thrive.

Despite various attempts, no DEX for BRC-20 or Runes has gained significant traction. The reason is clear: existing protocols lack the advanced functionalities required for DeFi, such as seamless asset transactions and smart contract interactions.

Most platforms that claim to offer decentralised trading still rely on custodial models, where users’ assets are effectively controlled by a centralised entity. This makes it challenging for truly decentralised systems to emerge, highlighting the need for a more robust infrastructure.

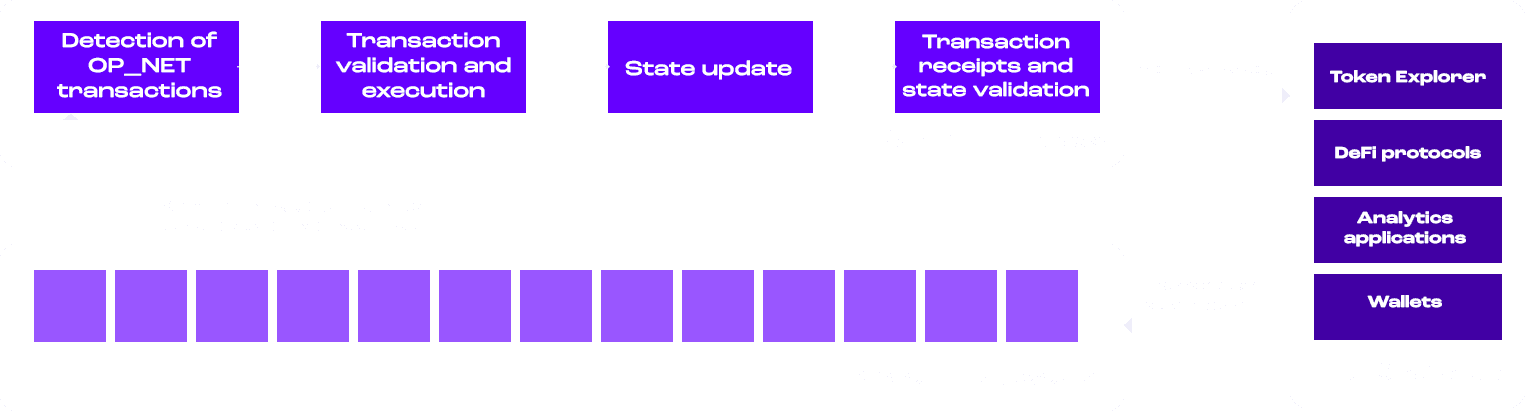

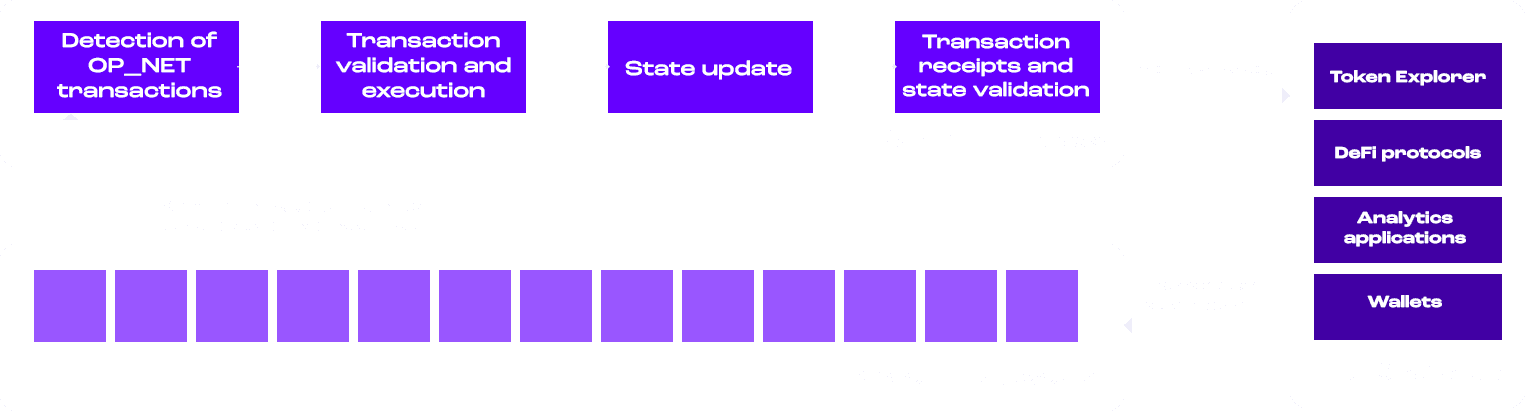

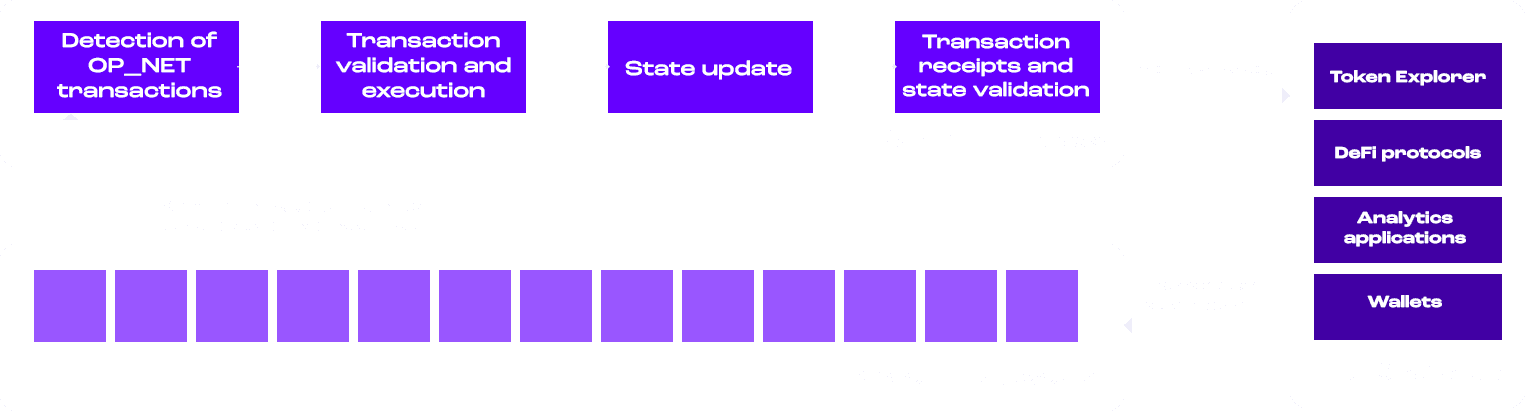

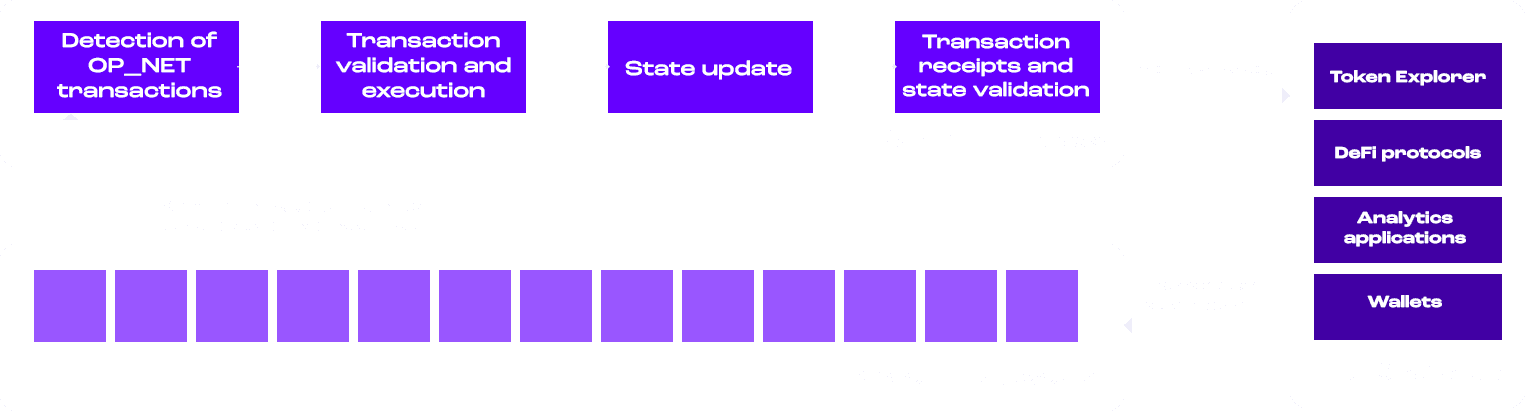

The Technological Edge: The Smart Contract Revolution

While Bitcoin’s existing metaprotocols, such as Ordinals and BRC-20, have opened the door for tokenisation, they fall short in delivering the advanced functionalities required for a thriving DeFi ecosystem. OP_NET addresses the core limitations of existing Bitcoin metaprotocols by introducing a Bitcoin-aligned smart contract metaprotocol, transforming the blockchain’s capabilities while upholding its fundamental principles.

Powered by Tapscript, this protocol supports Turing-complete smart contracts, meaning it offers a full suite of functionalities that unlock the potential for DeFi on Bitcoin. Unlike previous metaprotocols that rely on limited scripting commands, OP_NET enables permissionless smart contract deployment, facilitating the creation of decentralised exchanges, dApps, Layer 2 solutions, non-fungible tokens (NFTs), Wrapped Bitcoin, lending protocols, and more.

A key feature that sets the OP_NET protocol apart is its use of Bitcoin as the gas token, ensuring that all transaction fees remain Bitcoin-native, preserving the integrity and decentralisation of the network. The single address system provides a seamless user experience by eliminating the need for multiple wallets or complex transaction processes. This is a significant improvement over the tedious processes required by BRC-20 or Ordinals.

The Technological Edge: The Smart Contract Revolution

While Bitcoin’s existing metaprotocols, such as Ordinals and BRC-20, have opened the door for tokenisation, they fall short in delivering the advanced functionalities required for a thriving DeFi ecosystem. OP_NET addresses the core limitations of existing Bitcoin metaprotocols by introducing a Bitcoin-aligned smart contract metaprotocol, transforming the blockchain’s capabilities while upholding its fundamental principles.

Powered by Tapscript, this protocol supports Turing-complete smart contracts, meaning it offers a full suite of functionalities that unlock the potential for DeFi on Bitcoin. Unlike previous metaprotocols that rely on limited scripting commands, OP_NET enables permissionless smart contract deployment, facilitating the creation of decentralised exchanges, dApps, Layer 2 solutions, non-fungible tokens (NFTs), Wrapped Bitcoin, lending protocols, and more.

A key feature that sets the OP_NET protocol apart is its use of Bitcoin as the gas token, ensuring that all transaction fees remain Bitcoin-native, preserving the integrity and decentralisation of the network. The single address system provides a seamless user experience by eliminating the need for multiple wallets or complex transaction processes. This is a significant improvement over the tedious processes required by BRC-20 or Ordinals.

The Technological Edge: The Smart Contract Revolution

While Bitcoin’s existing metaprotocols, such as Ordinals and BRC-20, have opened the door for tokenisation, they fall short in delivering the advanced functionalities required for a thriving DeFi ecosystem. OP_NET addresses the core limitations of existing Bitcoin metaprotocols by introducing a Bitcoin-aligned smart contract metaprotocol, transforming the blockchain’s capabilities while upholding its fundamental principles.

Powered by Tapscript, this protocol supports Turing-complete smart contracts, meaning it offers a full suite of functionalities that unlock the potential for DeFi on Bitcoin. Unlike previous metaprotocols that rely on limited scripting commands, OP_NET enables permissionless smart contract deployment, facilitating the creation of decentralised exchanges, dApps, Layer 2 solutions, non-fungible tokens (NFTs), Wrapped Bitcoin, lending protocols, and more.

A key feature that sets the OP_NET protocol apart is its use of Bitcoin as the gas token, ensuring that all transaction fees remain Bitcoin-native, preserving the integrity and decentralisation of the network. The single address system provides a seamless user experience by eliminating the need for multiple wallets or complex transaction processes. This is a significant improvement over the tedious processes required by BRC-20 or Ordinals.

Key Features of OP_NET

Bitcoin Layer 1 Mechanisms: The protocol operates entirely on Bitcoin’s Layer 1, ensuring maximum security and decentralisation. Its execution layer, OP_VM, uses Bitcoin transactions and cryptographic proofs to validate contract states.

Smart Contract Deployment: Unlike Ethereum, which requires separate gas tokens for each contract deployment, OP_NET leverages Bitcoin’s Taproot script-path spends. This allows users to interact directly with contracts using Bitcoin, ensuring security and transparency, as every smart contract interaction is verifiable on Bitcoin’s public ledger.

WebAssembly (Wasm) Compatibility: The protocol supports smart contracts written in multiple languages, including AssemblyScript, Rust, Python, and Go. This multi-language compatibility, along with user-friendly developer tools, makes it appealing to both new and experienced developers.

Seamless UX and Single-Address System: The protocol virtualizes token management, reducing risks associated with accidental spending and simplifying user interactions. Users can continue to utilise their existing Bitcoin wallets while accessing the new features enabled by the protocol.

With its capability to efficiently handle large transaction volumes and Bitcoin’s unmatched security and decentralisation, OP_NET is well-equipped to support a diverse range of decentralised applications (dApps), from DeFi to NFTs, all while maintaining Bitcoin’s core principles.

Key Features of OP_NET

Bitcoin Layer 1 Mechanisms: The protocol operates entirely on Bitcoin’s Layer 1, ensuring maximum security and decentralisation. Its execution layer, OP_VM, uses Bitcoin transactions and cryptographic proofs to validate contract states.

Smart Contract Deployment: Unlike Ethereum, which requires separate gas tokens for each contract deployment, OP_NET leverages Bitcoin’s Taproot script-path spends. This allows users to interact directly with contracts using Bitcoin, ensuring security and transparency, as every smart contract interaction is verifiable on Bitcoin’s public ledger.

WebAssembly (Wasm) Compatibility: The protocol supports smart contracts written in multiple languages, including AssemblyScript, Rust, Python, and Go. This multi-language compatibility, along with user-friendly developer tools, makes it appealing to both new and experienced developers.

Seamless UX and Single-Address System: The protocol virtualizes token management, reducing risks associated with accidental spending and simplifying user interactions. Users can continue to utilise their existing Bitcoin wallets while accessing the new features enabled by the protocol.

With its capability to efficiently handle large transaction volumes and Bitcoin’s unmatched security and decentralisation, OP_NET is well-equipped to support a diverse range of decentralised applications (dApps), from DeFi to NFTs, all while maintaining Bitcoin’s core principles.

Key Features of OP_NET

Bitcoin Layer 1 Mechanisms: The protocol operates entirely on Bitcoin’s Layer 1, ensuring maximum security and decentralisation. Its execution layer, OP_VM, uses Bitcoin transactions and cryptographic proofs to validate contract states.

Smart Contract Deployment: Unlike Ethereum, which requires separate gas tokens for each contract deployment, OP_NET leverages Bitcoin’s Taproot script-path spends. This allows users to interact directly with contracts using Bitcoin, ensuring security and transparency, as every smart contract interaction is verifiable on Bitcoin’s public ledger.

WebAssembly (Wasm) Compatibility: The protocol supports smart contracts written in multiple languages, including AssemblyScript, Rust, Python, and Go. This multi-language compatibility, along with user-friendly developer tools, makes it appealing to both new and experienced developers.

Seamless UX and Single-Address System: The protocol virtualizes token management, reducing risks associated with accidental spending and simplifying user interactions. Users can continue to utilise their existing Bitcoin wallets while accessing the new features enabled by the protocol.

With its capability to efficiently handle large transaction volumes and Bitcoin’s unmatched security and decentralisation, OP_NET is well-equipped to support a diverse range of decentralised applications (dApps), from DeFi to NFTs, all while maintaining Bitcoin’s core principles.

Bitcoin as the One and Only Gas Token

One of the main core innovations of OP_NET protocol is its use of Bitcoin itself as the gas token, eliminating the need for additional tokens to cover transaction fees. This approach simplifies the transaction process by conducting all transactions and smart contract executions in Bitcoin, avoiding the complexities seen in other ecosystems, such as Ethereum's reliance on Ether (ETH) for gas payments.

Gas fees are split between a minimum execution fee (330 sats) and a priority fee for users seeking faster processing within a block. This mechanism ensures that Bitcoin miners remain incentivized, while also aligning with Bitcoin’s core principles. Additionally, it reduces Miner Extractable Value (MEV) by burning excess fees into the contract address, maintaining fairness and integrity in the network.

Wrapped Bitcoin and Cross-Chain Compatibility

OP_NET introduces Wrapped Bitcoin (WBTC), allowing users to use Bitcoin directly within its DeFi ecosystem without leaving the Bitcoin network. The proof-of-authority (PoA) system ensures that wrapping BTC is secure and optimised for UTXO management, facilitating decentralised exchanges, lending, and liquidity pools. This setup ensures secure, trust-minimised DeFi interactions.

In contrast to Ethereum, where users must rely on centralised custodians for wrapped assets, OP_NET’s wrapping system provides trust-minimised interaction, secured by post-quantum cryptographic techniques.

Expanding Token Standards: OP_20 and OP_721

The protocol enhances Bitcoin by introducing OP_20 (fungible tokens) and OP_721 (non-fungible tokens), similar to Ethereum’s ERC-20 and ERC-721 framework. These extensions enable the growth of decentralised marketplaces, gaming ecosystems, tokenized assets, and NFTs on the Bitcoin network, broadening the range of applications and functionalities available within the Bitcoin ecosystem.

OP_NET and the Future of Bitcoin DeFi

OP_NET is on track to disrupt the Bitcoin scene; it's transforming decentralised finance as we know it. By rolling out smart contract functionality on Bitcoin’s blockchain, it sets the stage for new ideas and wider adoption. The idea of DeFi on Bitcoin unlocks a largely untapped market for growth, and with Bitcoin’s unmatched trust, it is positioned to become a major player in this financial space.

As this protocol builds momentum, the excitement surrounding it goes far beyond just Bitcoin-based DeFi. It opens up the entire decentralised finance ecosystem to Bitcoin, unlocking new possibilities for applications, services, and financial systems that were previously unattainable within the Bitcoin network.

The Future of Bitcoin DeFi and Beyond

The protocol is set to not only transform the Bitcoin landscape but also redefine the future of decentralised finance. By introducing advanced smart contract functionality to the Bitcoin blockchain, it creates new opportunities for innovation and adoption. DeFi on Bitcoin represents an untapped market with vast growth potential, and the protocol’s seamless integration with the world’s most trusted cryptocurrency positions it to become a cornerstone of this new financial system.

With secure, efficient, and scalable smart contracts, the protocol turns Bitcoin into a platform for decentralised applications and finance, changing how we interact with the blockchain. As it gains momentum, the excitement goes beyond Bitcoin-based DeFi, it's about the wide range of possibilities the protocol unlocks across the entire ecosystem.

Introducing The First Ever Bitcoin DeFi Fund: Shaping the Future of Decentralised Finance on Bitcoin

At Peakable, we've observed that most investors view blockchain as a distinct asset class and prefer to have an expert partner manage allocations across its diverse opportunities.

In response, we are introducing the Peakable Bitcoin DeFi Fund, specifically structured to offer comprehensive exposure to the entire spectrum of Bitcoin-based DeFi opportunities. The fund provides investors with a focused approach to the Bitcoin ecosystem, enabling them to capitalise on its expanding potential as it evolves beyond a store of value.

Bitcoin as the One and Only Gas Token

One of the main core innovations of OP_NET protocol is its use of Bitcoin itself as the gas token, eliminating the need for additional tokens to cover transaction fees. This approach simplifies the transaction process by conducting all transactions and smart contract executions in Bitcoin, avoiding the complexities seen in other ecosystems, such as Ethereum's reliance on Ether (ETH) for gas payments.

Gas fees are split between a minimum execution fee (330 sats) and a priority fee for users seeking faster processing within a block. This mechanism ensures that Bitcoin miners remain incentivized, while also aligning with Bitcoin’s core principles. Additionally, it reduces Miner Extractable Value (MEV) by burning excess fees into the contract address, maintaining fairness and integrity in the network.

Wrapped Bitcoin and Cross-Chain Compatibility

OP_NET introduces Wrapped Bitcoin (WBTC), allowing users to use Bitcoin directly within its DeFi ecosystem without leaving the Bitcoin network. The proof-of-authority (PoA) system ensures that wrapping BTC is secure and optimised for UTXO management, facilitating decentralised exchanges, lending, and liquidity pools. This setup ensures secure, trust-minimised DeFi interactions.

In contrast to Ethereum, where users must rely on centralised custodians for wrapped assets, OP_NET’s wrapping system provides trust-minimised interaction, secured by post-quantum cryptographic techniques.

Expanding Token Standards: OP_20 and OP_721

The protocol enhances Bitcoin by introducing OP_20 (fungible tokens) and OP_721 (non-fungible tokens), similar to Ethereum’s ERC-20 and ERC-721 framework. These extensions enable the growth of decentralised marketplaces, gaming ecosystems, tokenized assets, and NFTs on the Bitcoin network, broadening the range of applications and functionalities available within the Bitcoin ecosystem.

OP_NET and the Future of Bitcoin DeFi

OP_NET is on track to disrupt the Bitcoin scene; it's transforming decentralised finance as we know it. By rolling out smart contract functionality on Bitcoin’s blockchain, it sets the stage for new ideas and wider adoption. The idea of DeFi on Bitcoin unlocks a largely untapped market for growth, and with Bitcoin’s unmatched trust, it is positioned to become a major player in this financial space.

As this protocol builds momentum, the excitement surrounding it goes far beyond just Bitcoin-based DeFi. It opens up the entire decentralised finance ecosystem to Bitcoin, unlocking new possibilities for applications, services, and financial systems that were previously unattainable within the Bitcoin network.

The Future of Bitcoin DeFi and Beyond

The protocol is set to not only transform the Bitcoin landscape but also redefine the future of decentralised finance. By introducing advanced smart contract functionality to the Bitcoin blockchain, it creates new opportunities for innovation and adoption. DeFi on Bitcoin represents an untapped market with vast growth potential, and the protocol’s seamless integration with the world’s most trusted cryptocurrency positions it to become a cornerstone of this new financial system.

With secure, efficient, and scalable smart contracts, the protocol turns Bitcoin into a platform for decentralised applications and finance, changing how we interact with the blockchain. As it gains momentum, the excitement goes beyond Bitcoin-based DeFi, it's about the wide range of possibilities the protocol unlocks across the entire ecosystem.

Introducing The First Ever Bitcoin DeFi Fund: Shaping the Future of Decentralised Finance on Bitcoin

At Peakable, we've observed that most investors view blockchain as a distinct asset class and prefer to have an expert partner manage allocations across its diverse opportunities.

In response, we are introducing the Peakable Bitcoin DeFi Fund, specifically structured to offer comprehensive exposure to the entire spectrum of Bitcoin-based DeFi opportunities. The fund provides investors with a focused approach to the Bitcoin ecosystem, enabling them to capitalise on its expanding potential as it evolves beyond a store of value.

Bitcoin as the One and Only Gas Token

One of the main core innovations of OP_NET protocol is its use of Bitcoin itself as the gas token, eliminating the need for additional tokens to cover transaction fees. This approach simplifies the transaction process by conducting all transactions and smart contract executions in Bitcoin, avoiding the complexities seen in other ecosystems, such as Ethereum's reliance on Ether (ETH) for gas payments.

Gas fees are split between a minimum execution fee (330 sats) and a priority fee for users seeking faster processing within a block. This mechanism ensures that Bitcoin miners remain incentivized, while also aligning with Bitcoin’s core principles. Additionally, it reduces Miner Extractable Value (MEV) by burning excess fees into the contract address, maintaining fairness and integrity in the network.

Wrapped Bitcoin and Cross-Chain Compatibility

OP_NET introduces Wrapped Bitcoin (WBTC), allowing users to use Bitcoin directly within its DeFi ecosystem without leaving the Bitcoin network. The proof-of-authority (PoA) system ensures that wrapping BTC is secure and optimised for UTXO management, facilitating decentralised exchanges, lending, and liquidity pools. This setup ensures secure, trust-minimised DeFi interactions.

In contrast to Ethereum, where users must rely on centralised custodians for wrapped assets, OP_NET’s wrapping system provides trust-minimised interaction, secured by post-quantum cryptographic techniques.

Expanding Token Standards: OP_20 and OP_721

The protocol enhances Bitcoin by introducing OP_20 (fungible tokens) and OP_721 (non-fungible tokens), similar to Ethereum’s ERC-20 and ERC-721 framework. These extensions enable the growth of decentralised marketplaces, gaming ecosystems, tokenized assets, and NFTs on the Bitcoin network, broadening the range of applications and functionalities available within the Bitcoin ecosystem.

OP_NET and the Future of Bitcoin DeFi

OP_NET is on track to disrupt the Bitcoin scene; it's transforming decentralised finance as we know it. By rolling out smart contract functionality on Bitcoin’s blockchain, it sets the stage for new ideas and wider adoption. The idea of DeFi on Bitcoin unlocks a largely untapped market for growth, and with Bitcoin’s unmatched trust, it is positioned to become a major player in this financial space.

As this protocol builds momentum, the excitement surrounding it goes far beyond just Bitcoin-based DeFi. It opens up the entire decentralised finance ecosystem to Bitcoin, unlocking new possibilities for applications, services, and financial systems that were previously unattainable within the Bitcoin network.

The Future of Bitcoin DeFi and Beyond

The protocol is set to not only transform the Bitcoin landscape but also redefine the future of decentralised finance. By introducing advanced smart contract functionality to the Bitcoin blockchain, it creates new opportunities for innovation and adoption. DeFi on Bitcoin represents an untapped market with vast growth potential, and the protocol’s seamless integration with the world’s most trusted cryptocurrency positions it to become a cornerstone of this new financial system.

With secure, efficient, and scalable smart contracts, the protocol turns Bitcoin into a platform for decentralised applications and finance, changing how we interact with the blockchain. As it gains momentum, the excitement goes beyond Bitcoin-based DeFi, it's about the wide range of possibilities the protocol unlocks across the entire ecosystem.

Introducing The First Ever Bitcoin DeFi Fund: Shaping the Future of Decentralised Finance on Bitcoin

At Peakable, we've observed that most investors view blockchain as a distinct asset class and prefer to have an expert partner manage allocations across its diverse opportunities.

In response, we are introducing the Peakable Bitcoin DeFi Fund, specifically structured to offer comprehensive exposure to the entire spectrum of Bitcoin-based DeFi opportunities. The fund provides investors with a focused approach to the Bitcoin ecosystem, enabling them to capitalise on its expanding potential as it evolves beyond a store of value.

LPs can choose from Class V (Venture) for venture equity, Class I (Illiquids) for venture equity, early-stage tokens, and locked-up treasury tokens, or Class A for all-in-one exposure across all Bitcoin DeFi assets.

LPs can choose from Class V (Venture) for venture equity, Class I (Illiquids) for venture equity, early-stage tokens, and locked-up treasury tokens, or Class A for all-in-one exposure across all Bitcoin DeFi assets.

LPs can choose from Class V (Venture) for venture equity, Class I (Illiquids) for venture equity, early-stage tokens, and locked-up treasury tokens, or Class A for all-in-one exposure across all Bitcoin DeFi assets.

We are committed to offering our Limited Partners (LPs) co-investment opportunities in select deals. LPs with larger capital commitments will have the opportunity to co-invest in at least 10% of each venture equity, private token, and special opportunity deal. As always, these opportunities are available on a capacity basis and are subject to minimal fees.

Peakable DeFi Fund I is targeting its first closing in Q4 2024. We invite you to learn more about this exciting opportunity by connecting with our team directly or visiting Peakable.io.invest

We are committed to offering our Limited Partners (LPs) co-investment opportunities in select deals. LPs with larger capital commitments will have the opportunity to co-invest in at least 10% of each venture equity, private token, and special opportunity deal. As always, these opportunities are available on a capacity basis and are subject to minimal fees.

Peakable DeFi Fund I is targeting its first closing in Q4 2024. We invite you to learn more about this exciting opportunity by connecting with our team directly or visiting Peakable.io.invest

We are committed to offering our Limited Partners (LPs) co-investment opportunities in select deals. LPs with larger capital commitments will have the opportunity to co-invest in at least 10% of each venture equity, private token, and special opportunity deal. As always, these opportunities are available on a capacity basis and are subject to minimal fees.

Peakable DeFi Fund I is targeting its first closing in Q4 2024. We invite you to learn more about this exciting opportunity by connecting with our team directly or visiting Peakable.io.invest

A message from Peakable's Founder

When we started Peakable, we saw a world where innovation drives meaningful change. Through our experience in venture capital, private equity, and technology, we’ve come to one clear conclusion: Bitcoin holds the key to the next evolution of decentralised finance.

Our partnership with OP_NET isn’t about following trends; it’s about unlocking new opportunities. Together, we’re expanding Bitcoin beyond its role as “digital gold,” turning it into the foundation of a fully decentralised financial ecosystem. With smart contracts on Bitcoin, we’ve unlocked the potential for decentralised exchanges, Layer 2 solutions, lending platforms, NFTs, and more.

We have always believed that real innovation comes from taking calculated risks and staying ahead of the curve.

That’s exactly what we are doing by focusing on Bitcoin DeFi, making this vision a reality with OP_NET as our partner.

Why This Matters to You

As a founder or investor, you know that timing is crucial, but having the right partner can make all the difference. We’re supporting founders in building on Bitcoin by providing early-stage investments, strategic guidance, and access to a robust network of partners and visionaries.

For investors, we offer exclusive access to a variety of early-stage asset classes that leverage Bitcoin’s emerging smart contract capabilities. Major institutions like BlackRock and Fidelity have already recognised Bitcoin’s potential, and interest is growing rapidly.

At Peakable, we’re ahead of the curve, building the bridges between institutional capital and the Bitcoin-based DeFi space. If you’ve been waiting for the right moment to get involved, this is it.

The Road Ahead

Our mission with the Peakable Bitcoin DeFi Fund is clear: Peakable will continue to lead the transformation of Bitcoin, turning it into the foundation of a mainstream financial system. We are backing projects that challenge the status quo and bring decentralised finance into the forefront of global finance.

I firmly believe that in the next few years, we’ll look back and realise that this was the moment when Bitcoin truly became the foundation for a new financial system.

I am incredibly excited about what’s to come, and I invite you to join us on this journey. Whether you’re a founder with an idea that could change the world, or an investor looking for the next big opportunity.

Peakable is the partner that can help you get there.

Let’s Build the Future of Technology Together

Thank you for your time, and I look forward to what we’ll accomplish together.

Cyrille de Lange

A message from Peakable's Founder

When we started Peakable, we saw a world where innovation drives meaningful change. Through our experience in venture capital, private equity, and technology, we’ve come to one clear conclusion: Bitcoin holds the key to the next evolution of decentralised finance.

Our partnership with OP_NET isn’t about following trends; it’s about unlocking new opportunities. Together, we’re expanding Bitcoin beyond its role as “digital gold,” turning it into the foundation of a fully decentralised financial ecosystem. With smart contracts on Bitcoin, we’ve unlocked the potential for decentralised exchanges, Layer 2 solutions, lending platforms, NFTs, and more.

We have always believed that real innovation comes from taking calculated risks and staying ahead of the curve.

That’s exactly what we are doing by focusing on Bitcoin DeFi, making this vision a reality with OP_NET as our partner.

Why This Matters to You

As a founder or investor, you know that timing is crucial, but having the right partner can make all the difference. We’re supporting founders in building on Bitcoin by providing early-stage investments, strategic guidance, and access to a robust network of partners and visionaries.

For investors, we offer exclusive access to a variety of early-stage asset classes that leverage Bitcoin’s emerging smart contract capabilities. Major institutions like BlackRock and Fidelity have already recognised Bitcoin’s potential, and interest is growing rapidly.

At Peakable, we’re ahead of the curve, building the bridges between institutional capital and the Bitcoin-based DeFi space. If you’ve been waiting for the right moment to get involved, this is it.

The Road Ahead

Our mission with the Peakable Bitcoin DeFi Fund is clear: Peakable will continue to lead the transformation of Bitcoin, turning it into the foundation of a mainstream financial system. We are backing projects that challenge the status quo and bring decentralised finance into the forefront of global finance.

I firmly believe that in the next few years, we’ll look back and realise that this was the moment when Bitcoin truly became the foundation for a new financial system.

I am incredibly excited about what’s to come, and I invite you to join us on this journey. Whether you’re a founder with an idea that could change the world, or an investor looking for the next big opportunity.

Peakable is the partner that can help you get there.

Let’s Build the Future of Technology Together

Thank you for your time, and I look forward to what we’ll accomplish together.

Cyrille de Lange

A message from Peakable's Founder

When we started Peakable, we saw a world where innovation drives meaningful change. Through our experience in venture capital, private equity, and technology, we’ve come to one clear conclusion: Bitcoin holds the key to the next evolution of decentralised finance.

Our partnership with OP_NET isn’t about following trends; it’s about unlocking new opportunities. Together, we’re expanding Bitcoin beyond its role as “digital gold,” turning it into the foundation of a fully decentralised financial ecosystem. With smart contracts on Bitcoin, we’ve unlocked the potential for decentralised exchanges, Layer 2 solutions, lending platforms, NFTs, and more.

We have always believed that real innovation comes from taking calculated risks and staying ahead of the curve.

That’s exactly what we are doing by focusing on Bitcoin DeFi, making this vision a reality with OP_NET as our partner.

Why This Matters to You

As a founder or investor, you know that timing is crucial, but having the right partner can make all the difference. We’re supporting founders in building on Bitcoin by providing early-stage investments, strategic guidance, and access to a robust network of partners and visionaries.

For investors, we offer exclusive access to a variety of early-stage asset classes that leverage Bitcoin’s emerging smart contract capabilities. Major institutions like BlackRock and Fidelity have already recognised Bitcoin’s potential, and interest is growing rapidly.

At Peakable, we’re ahead of the curve, building the bridges between institutional capital and the Bitcoin-based DeFi space. If you’ve been waiting for the right moment to get involved, this is it.

The Road Ahead

Our mission with the Peakable Bitcoin DeFi Fund is clear: Peakable will continue to lead the transformation of Bitcoin, turning it into the foundation of a mainstream financial system. We are backing projects that challenge the status quo and bring decentralised finance into the forefront of global finance.

I firmly believe that in the next few years, we’ll look back and realise that this was the moment when Bitcoin truly became the foundation for a new financial system.

I am incredibly excited about what’s to come, and I invite you to join us on this journey. Whether you’re a founder with an idea that could change the world, or an investor looking for the next big opportunity.

Peakable is the partner that can help you get there.

Let’s Build the Future of Technology Together

Thank you for your time, and I look forward to what we’ll accomplish together.

Cyrille de Lange

If you’re an Investor or Founder that wants to grow with Peakable;

If you’re an Investor or Founder that wants to grow with Peakable;

If you’re an Investor or Founder that wants to grow with Peakable;

CONTACT US

Receive the Latest news in Blockchain and Crypto

Receive the Latest news in Blockchain and Crypto

Receive the Latest news in Blockchain and Crypto

Subscribe to our Newsletter down below

SUBSCRIBE

Looking for a career in blockchain?

Looking for a career in blockchain?

Submit your profile to our portfolio companies to get discovered by the best blockchain companies out there. Our companies are seeking candidates who are passionate about the transformative power of blockchain technology. The most in-demand roles span engineering, business development, product management, and marketing/design.

JOIN THE TEAM