Crypto’s Global Takeover

"Will Bitcoin Dismantle Traditional Politics?"

September 24th, 2024

Blockchain Newsletter

Cyrille de Lange, Natalija Gavrilovic, Muhammad Wasil, Timotej Klinar

Cyrille de Lange, Natalija Gavrilovic, Muhammad Wasil, Timotej Klinar

The Crypto Revolution Hits Washington

What if the future of global politics wasn’t decided in Washington, Beijing, or Moscow but on the blockchain?

With the 2024 U.S. presidential election approaching, there's a silent player rewriting the political landscape, cryptocurrency. The digital evolution occurring is completely altering how strategies and alliances are formed, and where true power resides. Digital assets, for example Bitcoin, so far seen as the domain of tech enthusiasts, have now become central to political discussions worldwide.

This change is influencing worldwide economies and igniting a demand for alterations for the upcoming generations of voters. The current struggle for control over “the digital future” may affect more than only political contests within nations, but could also tip the scales of global dominance.

Are we witnessing the dawn of a crypto-driven global political transformation?

The Crypto Revolution Hits Washington

What if the future of global politics wasn’t decided in Washington, Beijing, or Moscow but on the blockchain?

With the 2024 U.S. presidential election approaching, there's a silent player rewriting the political landscape, cryptocurrency. The digital evolution occurring is completely altering how strategies and alliances are formed, and where true power resides. Digital assets, for example Bitcoin, so far seen as the domain of tech enthusiasts, have now become central to political discussions worldwide.

This change is influencing worldwide economies and igniting a demand for alterations for the upcoming generations of voters. The current struggle for control over “the digital future” may affect more than only political contests within nations, but could also tip the scales of global dominance.

Are we witnessing the dawn of a crypto-driven global political transformation?

The Trump Factor: From Skeptic to Enthusiast

The recent alteration in Donald Trump's views on cryptocurrency has created a big wave in politics. During the Bitcoin 2024 Conference held in Nashville US, the former US president and current running candidate for potentially another presidential mandate leading the Republican party, revealed his support for the cryptocurrency industry. His newfound standpoint on the topic came as a surprise to many, as in previous statements, he was showcasing only scepticism against the industry.

This dramatic shift in his conviction prompts us to question whether his sudden embrace of cryptocurrencies is merely a political tactic constructed to attract a new voter base, or is it a signal of the onset of a transformative era for crypto. As he positions himself as a “pro-crypto” candidate, the 2024 election implications could be profound.

This evolving narrative around Trump’s relationship with cryptocurrencies is a perfect example to show the growing intersection of politics and digital finance.

Institutional Adoption: The Billion Dollar Stamp of Approval

If we closely look at recent years, Bitcoin has experienced a very significant rise in institutional interest. For example, MicroStrategy made headlines when they invested billions of dollars into Bitcoin. This action pushed a domino effect and drove companies like Tesla and Square to follow in its footsteps and also invest in Bitcoin. But what caused the biggest impact for Bitcoin’s institutional adoption was with PayPal in 2020. The company made a drastic change in the market when they allowed millions of their daily users to buy, sell and use Bitcoin through their platform, making it a part of their everyday life. All of these events helped to facilitate the process of mass adoption of Bitcoin. The institutional backings allowed its price to reach new all time highs and legitimised it as an investment asset.

In 2024, the approval of the highly anticipated Bitcoin ETF marked a defining moment in the cryptocurrency's history.. After its launch in January, it opened the doors for major institutional capital, similar to the transformative effect that the gold ETFs had on the market after their introduction. BlackRock, one of the biggest asset management firms in the world, backing Bitcoin through an ETF means the future of Bitcoin as a mainstream cryptocurrency investment asset is cemented.

"Bitcoin is going to play a big role in the international financial system."

— Larry Fink, CEO of BlackRock, BlackRock Insights, June 2023.

Trump's Crypto Statements:

Bitcoin is a “Marvel of Technology”

"Bitcoin is not just a marvel of technology, as you know, it's a miracle of cooperation and human achievement."

The Crypto Capital Of The Planet

"This afternoon, I'm laying out my plan to ensure that the United States will be the crypto capital of the planet and the Bitcoin superpower of the world, and we'll get it done."

“This is all common sense that we're talking about today, and bitcoin and crypto will skyrocket like never before, even beyond your expectations, and you are the people that are doing it.”

“America will become the world's undisputed bitcoin mining powerhouse.”

What is Bitcoin?

"Bitcoin stands for freedom, sovereignty and independence from government coercion and control."

Trump’s Vision

“If we don't embrace crypto and Bitcoin technology, China will, other countries will, they'll dominate, and we cannot let China dominate. They are making too much progress as it is, and we want them to be successful. I want China to be successful, but we have to be the most successful.”

The Pledge

“And I pledge to the Bitcoin community that the day I take the oath of office, Joe Biden, Kamala Harris's anti crypto crusade will be over. It will end. It'll be done.”

“The moment I'm sworn in, the persecution stops and the weaponization ends against your industry and as long as I'm in the Oval Office.”

Bitcoin being a “Threat to the Dollar”

“Those who say that Bitcoin is a threat to the dollar have the story exactly backwards.”

“Bitcoin is not threatening the dollar. The behaviour of the current US government is really threatening the dollar..”

The Final Promise

“Ultimately, my promise to each and every one of you is this: I will be the pro-innovation and pro-Bitcoin president that America needs and our citizens deserve. This will be one industry, but this will be a thriving industry, a great industry, and I'm going to be doing the same thing for every other industry.”

-Donald Trump, Bitcoin 2024 Conference, Nashville, July 27, 2024

To compare, these declarations show a complete reversal from his 2019 tweet where he stated that he is "not a fan of Bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.”.

Trump's Crypto Statements:

Bitcoin is a “Marvel of Technology”

"Bitcoin is not just a marvel of technology, as you know, it's a miracle of cooperation and human achievement."

The Crypto Capital Of The Planet

"This afternoon, I'm laying out my plan to ensure that the United States will be the crypto capital of the planet and the Bitcoin superpower of the world, and we'll get it done."

“This is all common sense that we're talking about today, and bitcoin and crypto will skyrocket like never before, even beyond your expectations, and you are the people that are doing it.”

“America will become the world's undisputed bitcoin mining powerhouse.”

What is Bitcoin?

"Bitcoin stands for freedom, sovereignty and independence from government coercion and control."

Trump’s Vision

“If we don't embrace crypto and Bitcoin technology, China will, other countries will, they'll dominate, and we cannot let China dominate. They are making too much progress as it is, and we want them to be successful. I want China to be successful, but we have to be the most successful.”

The Pledge

“And I pledge to the Bitcoin community that the day I take the oath of office, Joe Biden, Kamala Harris's anti crypto crusade will be over. It will end. It'll be done.”

“The moment I'm sworn in, the persecution stops and the weaponization ends against your industry and as long as I'm in the Oval Office.”

Bitcoin being a “Threat to the Dollar”

“Those who say that Bitcoin is a threat to the dollar have the story exactly backwards.”

“Bitcoin is not threatening the dollar. The behaviour of the current US government is really threatening the dollar..”

The Final Promise

“Ultimately, my promise to each and every one of you is this: I will be the pro-innovation and pro-Bitcoin president that America needs and our citizens deserve. This will be one industry, but this will be a thriving industry, a great industry, and I'm going to be doing the same thing for every other industry.”

-Donald Trump, Bitcoin 2024 Conference, Nashville, July 27, 2024

To compare, these declarations show a complete reversal from his 2019 tweet where he stated that he is "not a fan of Bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.”.

The U.S. Government Bitcoin Stockpile Proposal

“Many Americans do not realise that the United States government is among the largest holders of bitcoin.”

“The federal government almost has 210,000 bitcoin or 1% total supply that will ever exist.”

“But for too long our government has violated the cardinal rule that every bitcoiner knows by heart: Never sell your bitcoin.”

“And so as the final part of my plan today, I am announcing that if I am elected, it will be the policy of my administration, United States of America, to keep 100% of all the bitcoin the U.S. government currently holds or acquires into the future, we'll keep 100%.”

“This will serve, in effect, as the core of the strategic national bitcoin stockpile. … Most of the bitcoin currently held by the United States government was obtained through law enforcement action.”

“Have a good time with your bitcoin and your crypto and everything else that you're playing with, and we're going to make that one of the greatest industries on Earth.”

-Donald Trump, Bitcoin 2024 Conference, Nashville, July 27, 2024

If his statements about retaining Bitcoin are veritable, Trump is hinting at a major shift in the U.S. economic strategy that could have an impact on their domestic policy, and also affect the way other nations approach digital currencies. This move is likely to position the country as a leader in the digital currency spectrum, and can pave the way for the worldwide economy to become more reliant on Bitcoin as well as other cryptocurrencies in the future.

The U.S. Government Bitcoin Stockpile Proposal

“Many Americans do not realise that the United States government is among the largest holders of bitcoin.”

“The federal government almost has 210,000 bitcoin or 1% total supply that will ever exist.”

“But for too long our government has violated the cardinal rule that every bitcoiner knows by heart: Never sell your bitcoin.”

“And so as the final part of my plan today, I am announcing that if I am elected, it will be the policy of my administration, United States of America, to keep 100% of all the bitcoin the U.S. government currently holds or acquires into the future, we'll keep 100%.”

“This will serve, in effect, as the core of the strategic national bitcoin stockpile. … Most of the bitcoin currently held by the United States government was obtained through law enforcement action.”

“Have a good time with your bitcoin and your crypto and everything else that you're playing with, and we're going to make that one of the greatest industries on Earth.”

-Donald Trump, Bitcoin 2024 Conference, Nashville, July 27, 2024

If his statements about retaining Bitcoin are veritable, Trump is hinting at a major shift in the U.S. economic strategy that could have an impact on their domestic policy, and also affect the way other nations approach digital currencies. This move is likely to position the country as a leader in the digital currency spectrum, and can pave the way for the worldwide economy to become more reliant on Bitcoin as well as other cryptocurrencies in the future.

The Tectonic Shift in Cryptocurrency Politics

From Wall Street to Pennsylvania Avenue, cryptocurrency is reshaping finance and altering the very fabric of political power as we know it. Unexpectedly, experienced figures from traditional finance are leading the transformation towards the acceptance of cryptocurrencies in political arenas.

Worth noting, former SEC Chair Jay Clayton, who was previously seen as having a conservative stance toward digital assets, is now advocating for a transparent cryptocurrency system.

In a recent CNBC interview, Clayton argued:

"If we don't address these issues, and address them in a way where our regulations work with the digital environment, we're going to have a real problem."

- Jay Clayton, CNBC interview, January 20, 2021

A large majority of congressmen share his opinion and believe that cryptocurrencies are an essential part for preserving America's economic advantage.

The Democratic party representative from New York, Alexandria Ocasio-Cortez, surprisingly proclaimed herself a crypto ally, questioning how cryptocurrencies could play into the U.S. financial system. Her statements came as unexpected since she has generally been advocating for progressive views on economic matters so far. This ties into the ongoing debate concerning the regulations and future of cryptocurrency in the U.S.

Technological Advancements: Scaling Bitcoin’s Utility

The future for Bitcoin isn't solely shaped by regulations or corporate adoption.

Technological advancements play an equally critical role in its global acceptance. Innovations similar to Layer 2 scaling solutions and new token protocols expanded Bitcoin’s utility beyond serving as a mere store of value. The Lightning Network, a second layer blockchain solution, has made significant progress by enabling faster and cheaper Bitcoin transactions, further encouraging its practicality in everyday use.

"We need to be asking questions about our financial system more broadly and how crypto plays into that."

- Alexandria Ocasio-Cortez, House Financial Services Committee Hearing, December 8, 2021

"We need to be asking questions about our financial system more broadly and how crypto plays into that."

- Alexandria Ocasio-Cortez, House Financial Services Committee Hearing, December 8, 2021

The Policy Puzzle: Crafting a Crypto Framework

Regulatory Tightrope

The increasing political focus on cryptocurrencies in the U.S. complicates the establishment of effective legislation. The "Responsible Financial Innovation Act," co-sponsored by Senators Kirsten Gillibrand and Cynthia Lummis, is designed with the purpose to provide a comprehensive regulatory framework for the cryptocurrency industry.

Key requirements of the act include:

Clarifying the variance between securities and commodities in the space

Establishing guidelines for digital assets' consumer protection

Creating tax regulations for crypto transactions

However, since the law might not have any effect on investor protection, it confronts a number of challenges. As Massachusetts senator Elizabeth Warren (D-MA) advised:

"Crypto is the new shadow bank. It provides many of the same services, but without the consumer protections or financial stability that back up the traditional system."

- Elizabeth Warren, New York Times interview, September 5, 2021

Financial Integration: Visa and Mastercard’s Stablecoin Integration

Financial integration developments continued in 2024, when Visa and Mastercard integrated stablecoins (USDC and Tether) into their global payments networks. This step allowed businesses and consumers to make everyday transactions using cryptocurrency stablecoins, making it more accessible and practical in daily financial activities. This move further reinforced Bitcoin’s role within the broader financial ecosystem by merging cryptocurrency with traditional financial systems.

Sharding and Scalability: Foundation for Mass Adoption

Sharding and Scalability: Foundation for Mass Adoption

— Vitalik Buterin, CoinDesk, 2020.

In a world where blockchain infrastructure must handle billions of transactions daily, scalability is an essential factor. Sharding solves this problem by dividing one blockchain into smaller and more manageable parts, which are known as “shards”. The shards then allow for multiple transactions to be processed at the same time across the entire network. By doing this, they significantly boost transaction capacity.

The success of sharding could inspire future upgrades on Bitcoin, helping it stay competitive as the decentralised economy continues to expand. More efficient blockchains mean more users, more applications, and ultimately, increased demand for Bitcoin as the cornerstone of the entire ecosystem.

National Security Angle

The discussion surrounding crypto legislation is becoming more and more focused on national security rather than just economics. Janet Yellen, the Treasury Secretary, recently cautioned in a confirmation hearing:

"Cryptocurrencies pose particular concerns about their potential use for illicit finance."

- Janet Yellen, Confirmation Hearing, January 19, 2021

There is a growing consensus between Republicans and Democrats concerning their perspectives on cryptocurrencies, and is a great indicator for a potential bipartisanship when it comes to cryptocurrency regulations.

National Security Angle

The discussion surrounding crypto legislation is becoming more and more focused on national security rather than just economics. Janet Yellen, the Treasury Secretary, recently cautioned in a confirmation hearing:

"Cryptocurrencies pose particular concerns about their potential use for illicit finance."

- Janet Yellen, Confirmation Hearing, January 19, 2021

There is a growing consensus between Republicans and Democrats concerning their perspectives on cryptocurrencies, and is a great indicator for a potential bipartisanship when it comes to cryptocurrency regulations.

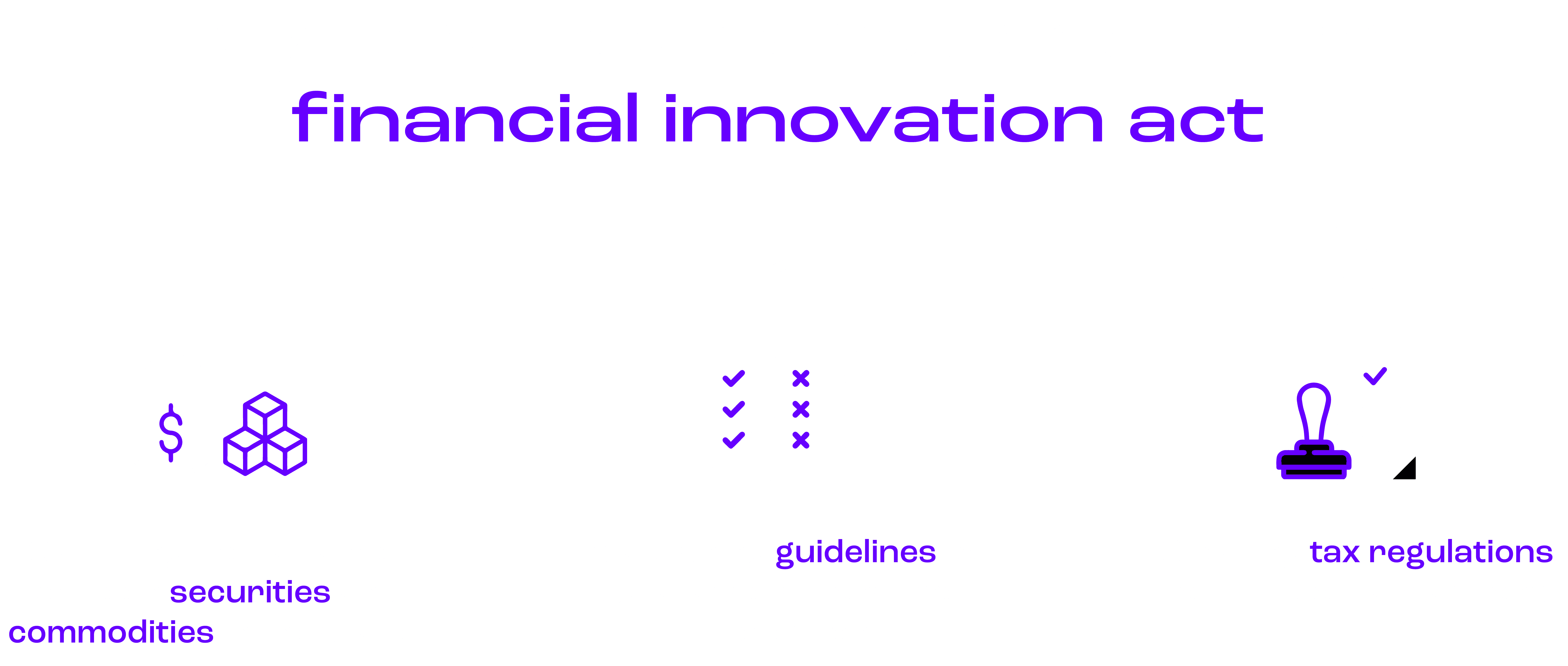

America's Crypto Stance on the World Stage

Each year there are more countries showing interest in researching the Central Bank Digital Currencies (CBDCs), which is causing the U.S. to fall under intense pressure to create its own "digital dollar."

As Jerome Powell, the chair of the Federal Reserve, recently declared:

"We're working proactively to issue a CBDC and, if so, in what form."

- Jerome Powell, Federal Reserve press conference, March 17, 2021

This action may have a massive impact on the cryptocurrency market as a whole and present a supported option from the government for decentralised digital assets.

America's Crypto Stance on the World Stage

Each year there are more countries showing interest in researching the Central Bank Digital Currencies (CBDCs), which is causing the U.S. to fall under intense pressure to create its own "digital dollar."

As Jerome Powell, the chair of the Federal Reserve, recently declared:

"We're working proactively to issue a CBDC and, if so, in what form."

- Jerome Powell, Federal Reserve press conference, March 17, 2021

This action may have a massive impact on the cryptocurrency market as a whole and present a supported option from the government for decentralised digital assets.

Source: Atlantic Council

As some nations speed up their efforts to create digital currencies supported by their governments, there are places such as El Salvador taking a different path by making Bitcoin a legal tender. At this pivotal moment in history the rise of decentralised currencies doesn't show signs of stopping, while the CBDCs are shaping a fresh financial landscape worldwide.

It’s clear the United States is well aware of the necessity of luring blockchain innovators to preserve its technological leadership. The secretary of commerce, Gina Raimondo, announced on "Blockchain for America" program, saying:

"We're committed to making the U.S. the global leader in blockchain technology. This initiative will provide resources and regulatory clarity to help American companies innovate and compete on the world stage."

As some nations speed up their efforts to create digital currencies supported by their governments, there are places such as El Salvador taking a different path by making Bitcoin a legal tender. At this pivotal moment in history the rise of decentralised currencies doesn't show signs of stopping, while the CBDCs are shaping a fresh financial landscape worldwide.

It’s clear the United States is well aware of the necessity of luring blockchain innovators to preserve its technological leadership. The secretary of commerce, Gina Raimondo, announced on "Blockchain for America" program, saying:

"We're committed to making the U.S. the global leader in blockchain technology. This initiative will provide resources and regulatory clarity to help American companies innovate and compete on the world stage."

The Voter Equation: Crypto as a Ballot Box Issue

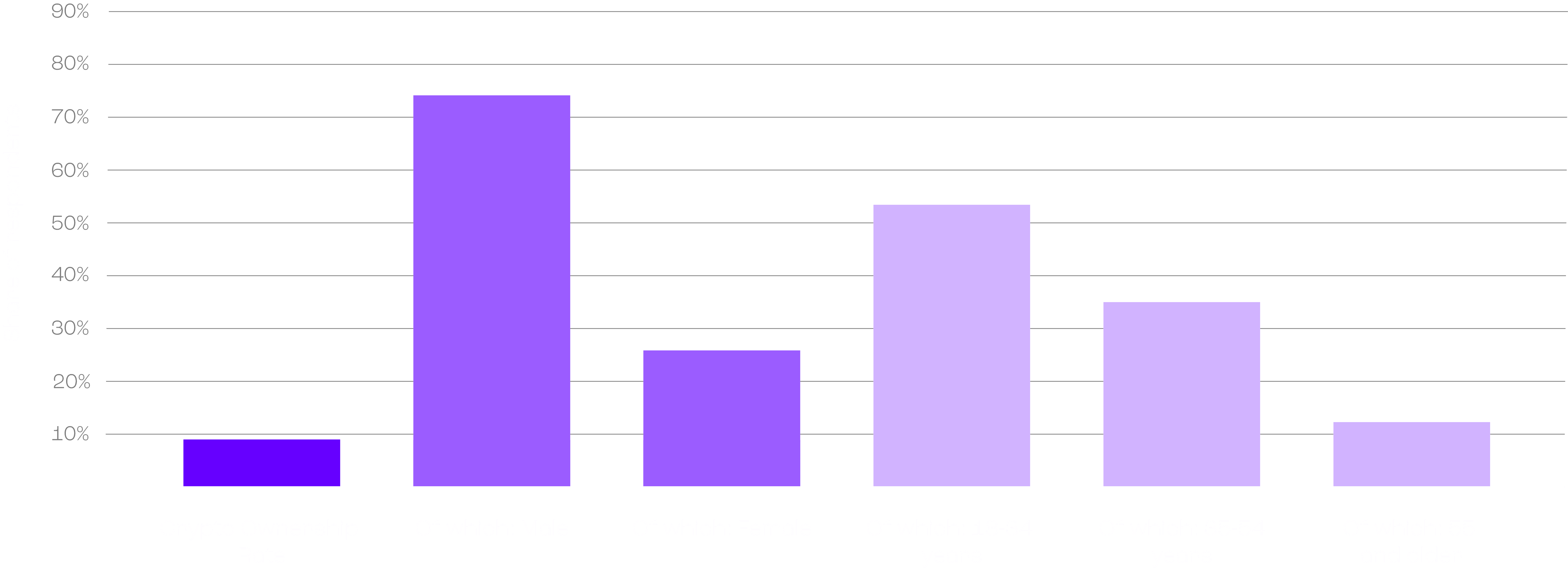

A recent Pew Research study discovered that 53% of Americans between the ages of 18-34 have invested in, traded, or used cryptocurrency on their own accord. This demographic views candidates' stances on crypto as a key factor in their voting decisions.

Sarah Huckabee Sanders, Governor of Arkansas, recently addressed this trend:

"We can't ignore the fact that young voters care deeply about the future of digital assets. As Republicans, we need to engage with this issue if we want to remain relevant to the next generation of voters."

The Voter Equation: Crypto as a Ballot Box Issue

A recent Pew Research study discovered that 53% of Americans between the ages of 18-34 have invested in, traded, or used cryptocurrency on their own accord. This demographic views candidates' stances on crypto as a key factor in their voting decisions.

Sarah Huckabee Sanders, Governor of Arkansas, recently addressed this trend:

"We can't ignore the fact that young voters care deeply about the future of digital assets. As Republicans, we need to engage with this issue if we want to remain relevant to the next generation of voters."

Source: Statista

The Economic Anxiety Factor

The charm of crypto reaches beyond the realm of youthful tech lovers. In areas suffering from the collapse of industrial jobs many voters view digital assets as a possible saviour for their economies. John Fetterman who serves as a Senator for Pennsylvania pointed out:

"In communities that have been left behind by traditional finance, crypto offers a glimpse of hope. We need to balance regulation with the potential for economic revitalization."

The Economic Anxiety Factor

The charm of crypto reaches beyond the realm of youthful tech lovers. In areas suffering from the collapse of industrial jobs many voters view digital assets as a possible saviour for their economies. John Fetterman who serves as a Senator for Pennsylvania pointed out:

"In communities that have been left behind by traditional finance, crypto offers a glimpse of hope. We need to balance regulation with the potential for economic revitalization."

The 2024 Crypto Playbook

As the 2024 elections approach, the candidates will need to develop a clear, nuanced stance on cryptocurrency and blockchain technology. Some key issues that are likely to rule the debate are:

Regulatory framework: How to balance innovation with consumer protection

Tax policy: Providing clarification on the taxation of cryptocurrency transactions and investments

National security: Addressing concerns about the money laundering capabilities of cryptocurrencies

Innovation policy: Preserving US dominance in the blockchain innovation

Financial inclusion: Properly analysing the potential of cryptocurrencies to provide underbanked people with access to banking services.

The candidate who can effectively navigate these complex issues may find themselves with a significant advantage at the ballot box.

A New Chapter in American Politics

Cryptocurrency has become a big topic in American politics signalling a huge change in the scene. This mirrors wider shifts in the economy, technology and who is voting. Heading towards 2024 the way hopefuls tackle this matter might just shape what's ahead for our economic framework and the state of our democratic values.

In the words of the former US president, Thomas Jefferson:

"I am not an advocate for frequent changes in laws and constitutions, but laws and institutions must go hand in hand with the progress of the human mind."

- Thomas Jefferson, letter to Samuel Kercheval, July 12, 1816

We must consider how the political dialogue and policies need to evolve as a response to the shifting concepts of money and value. Exploring the complex world of cryptocurrency is not just about understanding the technology and finance; it challenges our political system to adapt to swift technological advancements. The way governments address these challenges and seize new opportunities will significantly influence the future of American innovation, economic resilience and governance in the coming years.

Now, all that is left to see is if we're truly ready for the global political transformation that cryptocurrency is set to bring.

A New Chapter in American Politics

Cryptocurrency has become a big topic in American politics signalling a huge change in the scene. This mirrors wider shifts in the economy, technology and who is voting. Heading towards 2024 the way hopefuls tackle this matter might just shape what's ahead for our economic framework and the state of our democratic values.

In the words of the former US president, Thomas Jefferson:

"I am not an advocate for frequent changes in laws and constitutions, but laws and institutions must go hand in hand with the progress of the human mind."

- Thomas Jefferson, letter to Samuel Kercheval, July 12, 1816

We must consider how the political dialogue and policies need to evolve as a response to the shifting concepts of money and value. Exploring the complex world of cryptocurrency is not just about understanding the technology and finance; it challenges our political system to adapt to swift technological advancements. The way governments address these challenges and seize new opportunities will significantly influence the future of American innovation, economic resilience and governance in the coming years.

Now, all that is left to see is if we're truly ready for the global political transformation that cryptocurrency is set to bring.

Introducing The First Ever Bitcoin DeFi Fund: Shaping the Future of Decentralised Finance on Bitcoin

At Peakable, we've observed that most investors view blockchain as a distinct asset class and prefer to have an expert partner manage allocations across its diverse opportunities.

In response, we are introducing the Peakable Bitcoin DeFi Fund, specifically structured to offer comprehensive exposure to the entire spectrum of Bitcoin-based DeFi opportunities. The fund provides investors with a focused approach to the Bitcoin ecosystem, enabling them to capitalise on its expanding potential as it evolves beyond a store of value.

Introducing The First Ever Bitcoin DeFi Fund: Shaping the Future of Decentralised Finance on Bitcoin

At Peakable, we've observed that most investors view blockchain as a distinct asset class and prefer to have an expert partner manage allocations across its diverse opportunities.

In response, we are introducing the Peakable Bitcoin DeFi Fund, specifically structured to offer comprehensive exposure to the entire spectrum of Bitcoin-based DeFi opportunities. The fund provides investors with a focused approach to the Bitcoin ecosystem, enabling them to capitalise on its expanding potential as it evolves beyond a store of value.

LPs can choose from Class V (Venture) for venture equity, Class I (Illiquids) for venture equity, early-stage tokens, and locked-up treasury tokens, or Class A for all-in-one exposure across all Bitcoin DeFi assets.

LPs can choose from Class V (Venture) for venture equity, Class I (Illiquids) for venture equity, early-stage tokens, and locked-up treasury tokens, or Class A for all-in-one exposure across all Bitcoin DeFi assets.

We are committed to offering our Limited Partners (LPs) co-investment opportunities in select deals. LPs with larger capital commitments will have the opportunity to co-invest in at least 10% of each venture equity, private token, and special opportunity deal. As always, these opportunities are available on a capacity basis and are subject to minimal fees.

Peakable DeFi Fund I is targeting its first closing in Q4 2024. We invite you to learn more about this exciting opportunity by connecting with our team directly or visiting Peakable.io.invest

We are committed to offering our Limited Partners (LPs) co-investment opportunities in select deals. LPs with larger capital commitments will have the opportunity to co-invest in at least 10% of each venture equity, private token, and special opportunity deal. As always, these opportunities are available on a capacity basis and are subject to minimal fees.

Peakable DeFi Fund I is targeting its first closing in Q4 2024. We invite you to learn more about this exciting opportunity by connecting with our team directly or visiting Peakable.io.invest

A message from Peakable's Founder

When we started Peakable, we saw a world where innovation drives meaningful change. Through our experience in venture capital, private equity, and technology, we’ve come to one clear conclusion: Bitcoin holds the key to the next evolution of decentralised finance.

Our partnership with OP_NET isn’t about following trends; it’s about unlocking new opportunities. Together, we’re expanding Bitcoin beyond its role as “digital gold,” turning it into the foundation of a fully decentralised financial ecosystem. With smart contracts on Bitcoin, we’ve unlocked the potential for decentralised exchanges, Layer 2 solutions, lending platforms, NFTs, and more.

We have always believed that real innovation comes from taking calculated risks and staying ahead of the curve.

That’s exactly what we are doing by focusing on Bitcoin DeFi, making this vision a reality with OP_NET as our partner.

Why This Matters to You

As a founder or investor, you know that timing is crucial, but having the right partner can make all the difference. We’re supporting founders in building on Bitcoin by providing early-stage investments, strategic guidance, and access to a robust network of partners and visionaries.

For investors, we offer exclusive access to a variety of early-stage asset classes that leverage Bitcoin’s emerging smart contract capabilities. Major institutions like BlackRock and Fidelity have already recognised Bitcoin’s potential, and interest is growing rapidly.

At Peakable, we’re ahead of the curve, building the bridges between institutional capital and the Bitcoin-based DeFi space. If you’ve been waiting for the right moment to get involved, this is it.

The Road Ahead

Our mission with the Peakable Bitcoin DeFi Fund is clear: Peakable will continue to lead the transformation of Bitcoin, turning it into the foundation of a mainstream financial system. We are backing projects that challenge the status quo and bring decentralised finance into the forefront of global finance.

I firmly believe that in the next few years, we’ll look back and realise that this was the moment when Bitcoin truly became the foundation for a new financial system.

I am incredibly excited about what’s to come, and I invite you to join us on this journey. Whether you’re a founder with an idea that could change the world, or an investor looking for the next big opportunity.

Peakable is the partner that can help you get there.

Let’s Build the Future of Technology Together

Thank you for your time, and I look forward to what we’ll accomplish together.

Cyrille de Lange

A message from Peakable's Founder

When we started Peakable, we saw a world where innovation drives meaningful change. Through our experience in venture capital, private equity, and technology, we’ve come to one clear conclusion: Bitcoin holds the key to the next evolution of decentralised finance.

Our partnership with OP_NET isn’t about following trends; it’s about unlocking new opportunities. Together, we’re expanding Bitcoin beyond its role as “digital gold,” turning it into the foundation of a fully decentralised financial ecosystem. With smart contracts on Bitcoin, we’ve unlocked the potential for decentralised exchanges, Layer 2 solutions, lending platforms, NFTs, and more.

We have always believed that real innovation comes from taking calculated risks and staying ahead of the curve.

That’s exactly what we are doing by focusing on Bitcoin DeFi, making this vision a reality with OP_NET as our partner.

Why This Matters to You

As a founder or investor, you know that timing is crucial, but having the right partner can make all the difference. We’re supporting founders in building on Bitcoin by providing early-stage investments, strategic guidance, and access to a robust network of partners and visionaries.

For investors, we offer exclusive access to a variety of early-stage asset classes that leverage Bitcoin’s emerging smart contract capabilities. Major institutions like BlackRock and Fidelity have already recognised Bitcoin’s potential, and interest is growing rapidly.

At Peakable, we’re ahead of the curve, building the bridges between institutional capital and the Bitcoin-based DeFi space. If you’ve been waiting for the right moment to get involved, this is it.

The Road Ahead

Our mission with the Peakable Bitcoin DeFi Fund is clear: Peakable will continue to lead the transformation of Bitcoin, turning it into the foundation of a mainstream financial system. We are backing projects that challenge the status quo and bring decentralised finance into the forefront of global finance.

I firmly believe that in the next few years, we’ll look back and realise that this was the moment when Bitcoin truly became the foundation for a new financial system.

I am incredibly excited about what’s to come, and I invite you to join us on this journey. Whether you’re a founder with an idea that could change the world, or an investor looking for the next big opportunity.

Peakable is the partner that can help you get there.

Let’s Build the Future of Technology Together

Thank you for your time, and I look forward to what we’ll accomplish together.

Cyrille de Lange

If you’re an Investor or Founder that wants to grow with Peakable;

CONTACT US

Receive the Latest news in Blockchain and Crypto

Subscribe to our Newsletter down below

SUBSCRIBE

Looking for a career in blockchain?

Submit your profile to our portfolio companies to get discovered by the best blockchain companies out there. Our companies are seeking candidates who are passionate about the transformative power of blockchain technology. The most in-demand roles span engineering, business development, product management, and marketing/design.

JOIN THE TEAM